Financial independence isn’t just a goal—it’s a declaration.

It says: I make the rules, I choose my future, and I don’t need permission to thrive.

For women, financial independence means freedom from relying on anyone else—partners, employers, systems—not because we can’t, but because we choose to build on our own terms.

Whether you’re just starting out or deep into your self-made journey, here are the steps that will take you from surviving to fully sovereign.

Step 1: Redefine What Independence Means for You

Before we talk money, we talk mindset.

Financial freedom doesn’t look the same for every woman. For some, it’s quitting the 9–5. For others, it’s retiring early, traveling full-time, or simply knowing no one else controls their future.

Your definition sets the destination.

Step 2: Build Multiple Income Streams (and Protect Your Time)

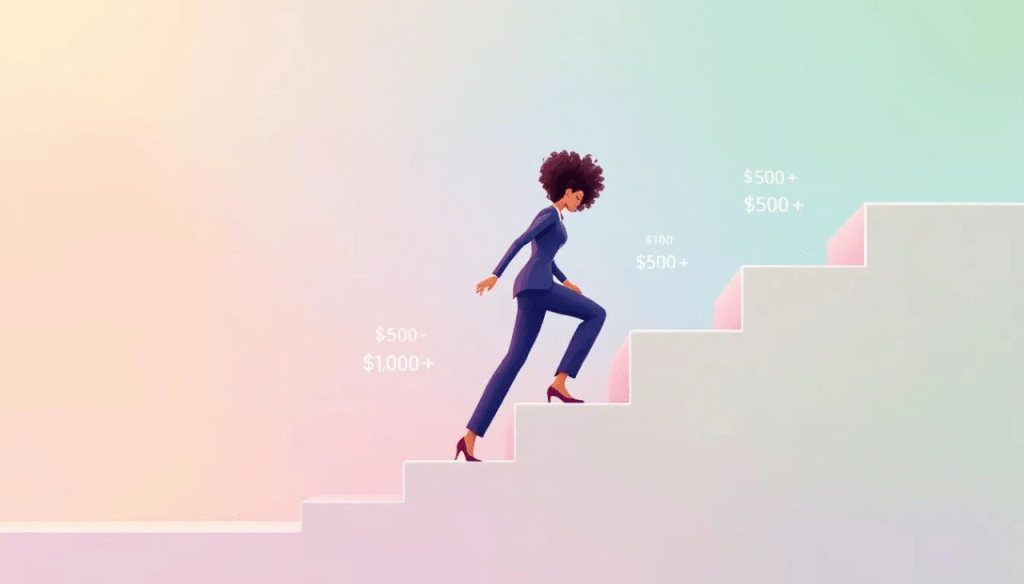

Relying on a single paycheck? That’s vulnerability.

Real independence means diversifying your income—through side hustles, digital products, investing, passive income, and self-employment.

You don’t need to hustle endlessly. You need systems that support you, even when you’re resting.

🖤 Start small:

- Launch a digital product

- Monetize a blog or YouTube channel

- Start investing with just $100

Step 3: Prioritize Financial Security—Not Just Income

Being self-made is about building wealth that lasts.

That means creating a solid foundation that holds up, even during a life pivot or market dip.

Key elements of financial security:

- An emergency fund (3–6 months of expenses)

- Automated savings + retirement contributions

- Debt management or payoff plans

- Long-term investing strategy

Even if you’re starting from zero, consistency builds power. Automate where you can. Track what matters.

Step 4: Invest in Yourself First

Courses. Mentorship. Boundaries. Rest.

These aren’t luxuries—they’re investments.

If financial independence is the outcome, personal growth is the engine.

Boss moves don’t come from burnout—they come from strategy, support, and staying in alignment with your bigger goals.

Step 5: Reevaluate, Reinvent, Reclaim

As you evolve, so will your version of financial freedom.

Maybe your business scales. Maybe your goals change. Maybe you pivot from career-focused to legacy-building. That’s the beauty of this journey: you get to change the rules anytime.

Independence doesn’t mean doing everything alone. It means having the freedom to choose your life—again and again—with no apologies.

Final Thoughts

Financial independence is about more than money—it’s about power.

The power to say no. The power to walk away. The power to design your life without waiting for permission.

You don’t need to wait until you’re debt-free, or making six figures, or “ready.”

You just need to start.

Because the most powerful thing a woman can do?

Choose herself—and back that choice with action.

Leave a comment