Forget the dusty spreadsheets and guilt-ridden “no spend” challenges. This isn’t about budgeting like your broke ex. It’s about owning your money like a boss—with confidence, clarity, and zero apologies.

Whether you’re rebuilding, starting fresh, or scaling your income, boss babe budgeting isn’t about restriction—it’s about alignment. Because financial power isn’t just about what you earn. It’s about how intentionally you spend, save, and invest like the independent woman you are.

Let’s break it down.

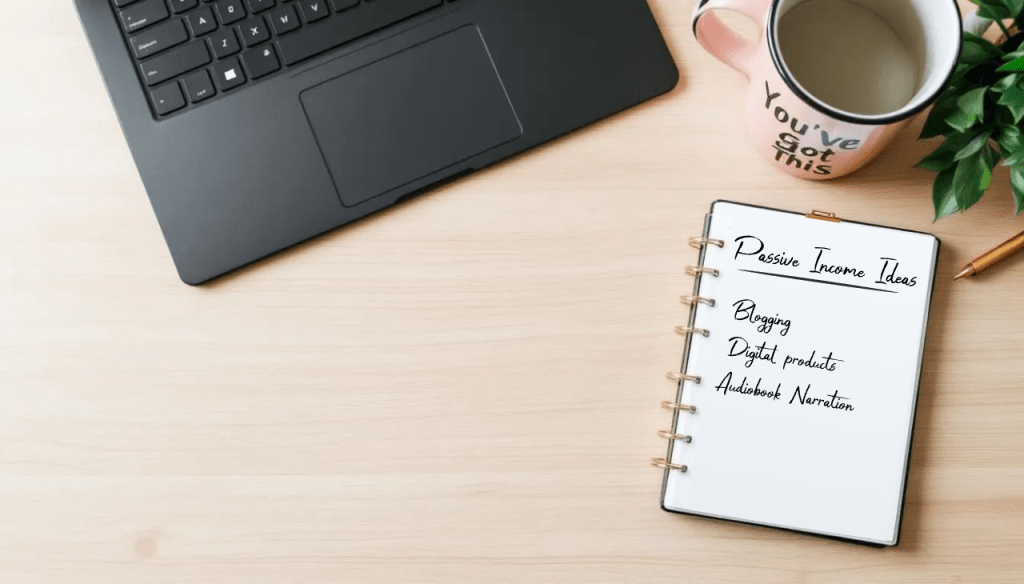

Step 1: Start with What You Value—Not What TikTok Says

The first mistake most women make? Trying to cram themselves into a budget that doesn’t fit their actual life.

Boss babe budgets are lifestyle-first.

That means creating a spending plan that aligns with what you care about—whether that’s travel, skincare, horses, or building your own business empire.

Step 2: Know Your Numbers—Without the Shame Spiral

Empowered women don’t avoid the truth—they use it.

Start by tracking:

- What’s coming in (total income streams)

- What’s going out (fixed + variable expenses)

- What’s leaking (subscriptions, late fees, etc.)

- What’s missing (savings, investments, future you)

Use budgeting apps or even a pretty Google Sheet to get clarity fast.

Reminder: Looking at your money isn’t judgment—it’s data. Data = power.

Step 3: Pay You First—Always

Boss babes don’t wait for the leftovers.

Automate your savings, investing, or debt payoff the moment income hits your account.

Even if it’s $10/week—it’s the habit that changes everything.

Create buckets for:

- Emergency fund

- Investing

- Fun money (yes, fun is a financial priority)

- Business or education goals

Step 4: Ditch the Guilt—and Spend With Confidence

A real budget doesn’t say “no” to everything you love.

It says “yes” to what truly matters—and “not right now” to the rest.

That $7 latte isn’t ruining your financial future.

Impulse buying every time you feel emotionally drained? That’s a pattern worth checking in with.

Budgeting isn’t punishment. It’s permission.

Permission to say yes to things that align with the woman you’re becoming.

Step 5: Revisit + Recalibrate Often

Boss babe budgets are living documents—not rules carved in stone.

Update your budget monthly or seasonally:

- Got a raise? Adjust.

- Planning a trip? Rebalance.

- Expenses went up? Re-evaluate.

Your budget should grow and flex with you—just like your goals, values, and income.

Final Thoughts

You don’t need to give up your lifestyle to gain financial freedom.

You just need a plan that matches your mindset—ambitious, intentional, and unapologetic.

Boss babe budgeting isn’t about doing it perfectly.

It’s about doing it like it matters—because you do.

Leave a comment